Whatcom Dream started in the laundry room of an apartment complex in 1999, with the idea of providing financial education and opportunities to those who needed it most. Since then, the program has continued to grow and touch the lives of more and more people. Bank of the Pacific has always had a hand in helping organizations throughout Whatcom County, but this relationship goes deeper than philanthropy.

Bank of the Pacific Compliance Specialist Lead Kelly Hoekema has seen firsthand the value of Whatcom Dream. “I’m not just somebody sitting at a bank, disconnected,” she says. “This program got me out of the cycle and the psychology of being low income.”

Hoekema says she would not have gotten where she is today without the financial stability piece that she learned from Whatcom Dream. “It’s so important, and it’s something you don’t get taught when you’re low income.”

Bank of the Pacific’s goal in working with Whatcom Dream is to help the greater community by sharing the knowledge used at the financial institution every day. “Equity can only happen if we all rise together,” says Hoekema. “That takes work — and our two organizations are willing to do that work.”

Trudy Shuravloff is another graduate of the program. Afterwards, she obtained a Human Services degree, and then came right back to Whatcom Dream as its executive director. The financial empowerment she learned is still being taught, and now there are other programs like scholarships, a back-to-school program, private coaching, and an emergency fund.

Shuravloff is quick to mention the importance of Bank of the Pacific stepping up to partner with them by providing volunteers for events, guest speakers for classes, or providing one-on-one time they spend with Whatcom Dream students. This help is invaluable to us as a nonprofit,” she says. “It is through this collaboration that we can help people reach their dreams, such as starting a business or becoming a homeowner.”

Hoekema agrees. “The great part about having a banker partner with you on financial literacy is that it builds relationships that can last a lifetime,” she says. “We get to watch individuals set financial goals, and then we can help them achieve those goals together.”

When Shuravloff talks about Whatcom Dreams programs, she often uses two phrases: hand up, and pay it forward.

“With the Christmas Shoppe, we ask the community for donations of new, quality toys. Our donors to leave the price tag on, and then we mark the price down 75% to 90%,” she says. Graduates are invited to come and shop for Christmas presents, and the Whatcom Dream values swing into action. “They’re getting a break on the prices of quality items, and all of the money they’ve spent goes into putting on another financial class for another set of students. So, they’re getting a hand up, and they’re paying it forward. That’s how all of our programs work.”

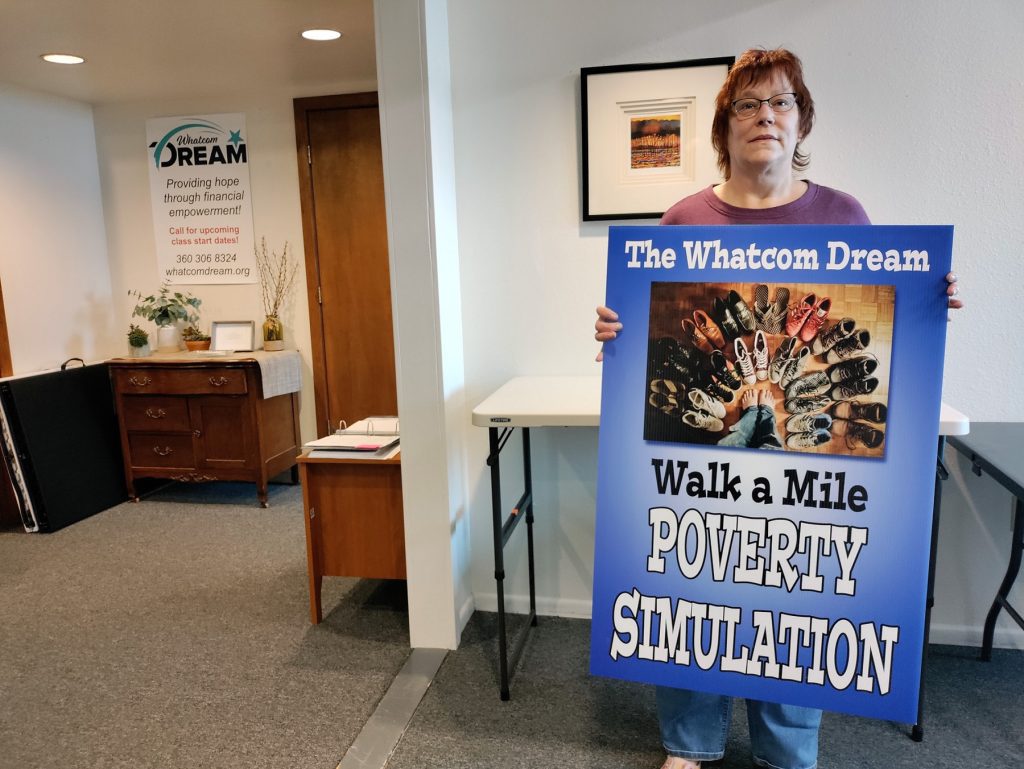

But Whatcom Dream also offers one program that’s not meant for people living without enough money. A couple times a year, they invite more affluent members of the community to take part in what they call a Poverty Simulation. The goal is to help give people a visceral understanding of what daily life is like below the poverty line. “When they do, they’re a little less quick to judge, and they’re a little more empathetic and compassionate,” says Shuravloff. “And that’s a good thing in our community.”

On Wednesday, April 19th, Whatcom Dream invites people interested in learning more to Lynden to take place in a learning experience. It starts with a typical meal you would be served in a low-income household — what Shuravloff describes as good, but thrifty. Then, each participant is assigned a character with a name and an age, and it’s time to track down the strangers that will be playing family members.

Once they’re all together, each family receives a packet of information that spells out their circumstances and and the sorts of things they’ll need to accomplish during the simulation.

“If there’s a child in your family, you’re going to have to take that kid to school. Perhaps you have so many bus passes, perhaps you have a car,” Shuravloff says. You may have other children, maybe you have a job, or you could have a disability. It could be any number of things, and you have to make your life work.”

These families all live in a town called Realville, which is represented by tables set up around the room that serve as different community services and resources. “There’s a bank, a shopping center, a community action agency, an employer, a utility company, a pawn broker, grocery store, DFS office, a payday loan, a mortgage company, a school, and a childcare facility,” says Shuravloff. “There’s a jail, as well,” The tables are staffed by volunteers who interact with the family members and help to make the simulation real.

With everyone in their roles, and everyone’s advantages and challenges in mind, it’s time for each family to survive for one month. “Every 15 minutes is one week. I have a big bell in the front, and when I ring that bell, your job is to keep a roof over your head, get your kids to school, get yourself to work, get to the grocery store. At the end of 15 minutes, you go back to your family, you strategize, and then you try to make it work again,” says Shuravloff. “We do this four times, and then at the very end we get together and debrief. And it is profound.”

Shuravloff says that many players discover what she calls ‘the tyranny of the moment,’ the feeling of sustained crisis that comes with not being able to get on top of life’s challenges.

“There are always tears, and there’s usually some anger. People can feel the injustice, and they speak to it,” she says. “People experience the hopelessness and the discouragement and the frustration, and then we talk about what we can do about it.”

Shuravloff sees a lot of value in the conversations at the end of the simulated month, because minds have been opened and viewpoints have changed.

“Volunteers and participants alike leave with a deeper understanding of how to live with limited resources and systems that are at best difficult to navigate and even at times unjust,” she says. “We do this to break down stereotypes and to sensitize people to what it feels like, and how difficult it is to live that way.”

The event is free of charge, and space can be reserved on the Whatcom Dream website. It will take place at 5:30 p.m. on Wednesday, April 19th, at Sonlight Community Church, located at 8800 Bender Road in Lynden.

To learn more about Bank of the Pacific and its commitment to partnering with community organizations in Whatcom County and beyond, please visit bankofthepacific.com/community-involvement.

Featured photo courtesy Whatcom Dream

Sponsored