’Tis that season of reckoning and, perhaps, rewards—tax season. But it doesn’t have to feel like a scary puzzle; there are free resources out there to help.

Ways to File

Let’s start with what resources or approved partner channels the IRS has for you to get your information to them in 2020.

e-File

According to the IRS website, there are four ways to file online for individuals/non-organizational filers, and a couple of them are free.

The first is IRS Free File or Fillable Forms. Combined, they’re the IRS providing you with an electronic way to prepare and submit your return without paying a third party intermediary. If your Adjusted Gross Income (AGI: what your total income is after removing qualifying expenses, interest, or contributions to retirement accounts) is $69,000 or less, you can use Free File. Free File is the opportunity to use what would normally be paid tax preparation software that guides you through the process, creates a return, and submits it to the IRS. For free. Here’s a handy flyer. To find the product that works for you, use this easy tool that matches you to a “free” product.

Fillable forms are for folks who have AGI higher than $69,000, so those persons don’t qualify for the free use of the various commercial tax prep software. If you’re able to navigate the forms in paper and understand how to file a return (or if you get help from some of the resources I’m going to list later), this is a way to e-file for free. Much like the written instructions for paper forms, there are online instructions for fillable forms.

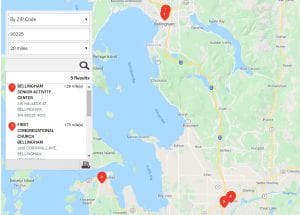

The second overall free way to e-file is by using a free tax return preparation program. Perhaps you aren’t aware, but there are volunteers empowered by the IRS to help you file if you meet certain criteria. Two such initiatives are VITA (Volunteer Income Tax Assistance), and TCE (Tax Counseling for the Elderly). This handy document (3676-B) lets you know in English or Spanish what tax stuff these programs can and can’t help you with, and what to bring. Locations for these programs and AARP Tax-Aide in Whatcom County are listed below. The AARP assistance program is great in that it does not have an age or income qualification to see help, but note their volunteers cannot prepare returns with rental income, farm income or small business returns with employees, depreciation, or expenses over $25,000.

The third and fourth ways to e-File aren’t free, but they do allow you to seek out whatever resources you feel you need: commercial tax preparation software, or paid tax return providers. The IRS has a searchable database of authorized e-file providers.

File by Mail

In case you were curious if this still exists for individual tax payers, it does. You may order or download the forms from the IRS website to either receive by mail or print at home. If you want to make sure you’re mailing your return to the correct place, here are the filing addresses for Washington State.

Help from the IRS

You don’t have to take my word for it: there’s a local office that can also give you the full scoop. You have to call to make an appointment to speak to someone, but they provide a list of things they can help with at the Bellingham office so you can make sure you’re not wasting your time.

Additionally, the IRS is really trying to empower you with self-service. Here are just some of the things that you can do online:

- set up a payment plan

- get a transcript of your tax return

- make a payment

- check on your refund

- find answers to many of your tax questions

- file your tax return online

- view your account information

They also have the Interactive Tax Assistant, an online query tool that can walk you to answers for many confusing tax questions such as “What is my filing status,” “Do I need to file a return,” or “Who can I claim as a dependent.” Find links to all of the IRS online resources on their Tools Page.